For any current or aspiring business owner, there are three little numbers you’ll want to pay close attention to, even if they don’t seem to be directly related to your business.

That’s right – your personal credit score.

Personal and business credit aren’t seen as completely separate by lenders. A personal credit score can take on increased importance for business owners who seek a loan backed by the Small Business Administration (SBA). SBA loans are a desirable form of financing for small business owners for a multitude of reasons, including favorable rates and terms, flexibility of uses, and lower collateral requirements.

Why Your Personal Credit Matters for Your Business

When applying for a loan, particularly if you are starting a new business, a lender will view your personal credit as a reflection of how you’ll handle your business credit. If a credit report shows past-due payments, accounts in collection, or over-utilization of credit, it could raise concerns that you won’t take your obligation to pay back your business loan seriously.

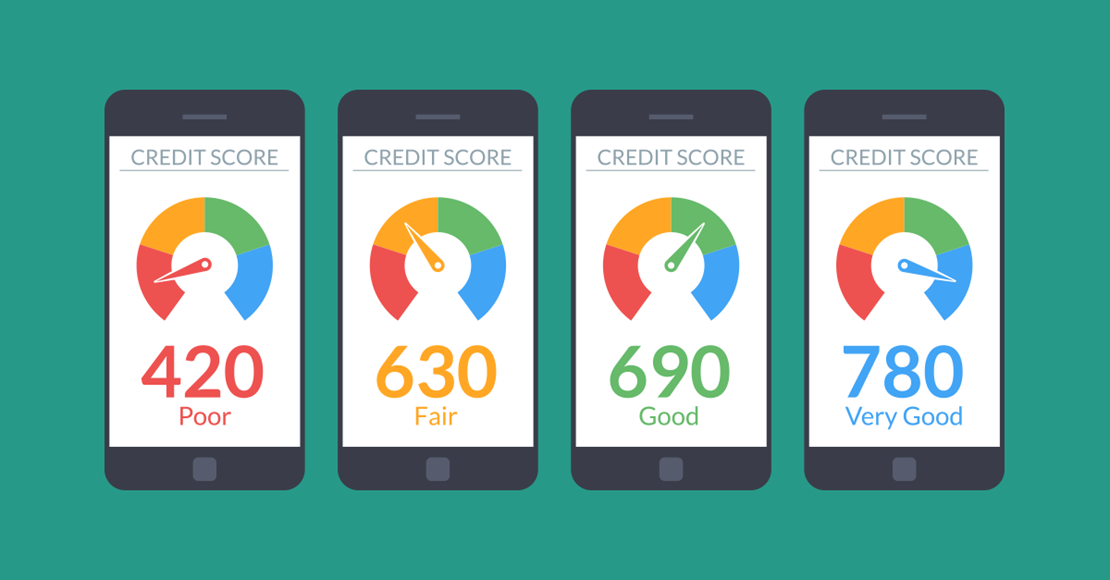

When it comes to qualifying for an SBA loan, a borrower’s credit score is an important consideration when making approval decisions. Though the SBA doesn’t set a firm rule for a minimum credit score requirement, SBA lenders like LSB have their own credit scoring guidelines. At LSB, we typically look for a minimum credit score of 640, but will consider extenuating circumstances and mitigating factors if a borrower has a score below that.

Overcoming Challenges and Past Mistakes

In the midst of the coronavirus pandemic, many businesses and individuals are facing financial hardship. If you’ve been negatively impacted, there are resources available that can keep your credit report in good standing.

- Contact your lender to determine what COVID-19 relief is available. If you are an LSB customer experiencing hardship, contact us to work out a solution that best fits your needs.

- If you have a federally-backed mortgage or student loan, the CARES Act offers options to request loan forbearance, where your payments can be suspended or reduced temporarily until you regain financial stability. If your loan is in good standing, it will remain so until the forbearance period is up.

- Determine what state and local resources are available to help. In Iowa, you may be eligible for programs that provide housing support or energy bill assistance.

Be sure to check your credit report periodically to ensure it’s accurate and up-to-date. Address any errors and ensure the corrections are reflected. If you have made credit mistakes in the past, make sure to resolve the situations and continue to make payments on-time. Have explanations ready when it comes time to seek a loan. The longer your accounts remain in good standing, the more creditworthy you will appear.

Tips for Maintaining Credit Score

If a small business loan through the SBA could be part of your future, follow these tips for maintaining the health of your credit score.

- Take all bills seriously and don’t pay late.

- Avoid overutilizing lines of credit – try to stay below 30% of your credit limit.

- Keep longstanding credit accounts open. The length of your credit history is a factor in your credit score. If you’ve had a credit card for a long time, keep the account open to increase the average credit age.

- Maintain a good debt-to-equity ratio and aim for total loan debt less than 30% of equity.

- Open new lines of credit only when necessary – a lot of inquiries or opening many new accounts in a short timeframe can lower credit score and be a red flag for lenders.

- Monitor your credit report for accuracy and fraud, and resolve issues quickly.

When you’re ready apply for an SBA loan, contact the small business lending team at LSB! Our lenders have specialized knowledge of SBA programs and will help you create the financial solution that’s a perfect fit for your business.